If only buying a new office printer were as cheap as one might hope.

Unfortunately, a high-quality printer is more expensive than one might think.

This is especially the case when you’re dealing with commercial or production-grade machines. These can easily cost thousands or even tens of thousands of dollars.

If you’ve started shopping and found the machine you need, you’re likely wondering how you’ll pay for it and what your options are.

Fortunately, you have multiple payment options at your disposal, so you don’t have to take on such a hefty short-term business cost if you don’t have the financial means or desire to do so.

As print vendors, we’ve worked with customers for over 35 years to help them find not just the right printer, but also the smartest way to pay for it.

In this blog, we’ll break down the four most common payment methods companies use to buy a printer or copier. We will also explain the pros and cons of each so you can decide what works best for your budget and workflow.

Keep in mind that not all print providers or vendors will offer the same payment options for their equipment.

Table of Contents

- Leasing a Printer

- Paying with Cash or ACH

- Using a Credit Card

- Financing Through Your Bank

- Which Option Is Right for You?

- Your Printer Purchase, Your Way

1. Leasing a Printer

Leasing is the most common way businesses pay for their printers. It works the same way as leasing a car. You get the machine, use it for a few years, and make a fixed monthly payment for it.

Your monthly payments depend on several factors. These include the type of machine you choose, the length of your lease, the interest rate applied by the leasing company, and any additional services you choose to include at purchase.

Pros of Leasing a Printer:

- Predictable monthly payments make it easier to budget.

- No huge upfront cost, which keeps your cash flow healthy.

- Service contracts often come bundled in, so things like maintenance and automatic toner shipmentsare covered.

- Upgrade flexibility if your business grows and you need a more robust device down the road.

Cons of Leasing a Printer:

- You’re tied into a contract, which is typically 3 to 5 years.

- Interest is applied, and rates can vary depending on your credit.

- You’ll need to qualify for financing, which may not be an option for every business.

Want to learn more? Check out these resources:

- Leasing vs. Purchasing a Printer: Which Is Right for You?

- 3 Reasons Your Credit Won't Be Approved for Leasing and What to Do About It

- A Comprehensive Guide to Copier Lease Agreements

2. Paying with Cash or ACH

If you’ve got the funds available, paying upfront with cash or ACH (automated clearing house) transfer is often the most straightforward and cost-saving option.

At STPT, we accept ACH payments for your convenience. It’s a secure, fast, and low-hassle way to pay without relying on physical checks.

Pros of Paying with Cash or ACH:

- No contracts or interest rates to worry about.

- You fully own the machine, which means you can resell or trade it in later.

- One-time payment, so you’re one and done.

Cons of Paying with Cash or ACH:

- Not every business has the capital to spend thousands upfront.

- Maintenance and toner aren’t always included, so you’ll have to source those separately or opt in to a service plan.

If you go this route, we recommend bundling in a maintenance plan to avoid unexpected repair costs later.

Learn more about the benefits of a maintenance plan for your printer here.

3. Using a Credit Card

Some vendors (including us) allow you to pay with a business or personal credit card. While it’s less common for printers, it can still be a useful option.

Pros of Using a Credit Card:

- Reward points or cashback if your card offers them.

- Introductory 0% interest offers on new cards (if you qualify).

- It’s a good backup plan if leasing isn’t an option for you.

Cons of Using a Credit Card:

- Some vendors charge processing fees for credit card payments.

- If you don’t pay the balance in time, interest can rack up quickly.

This payment method is best if you're looking to spread costs over a few months and already have a good financial system in place to manage credit use.

4. Financing Through Your Bank

This option is a little more DIY, but if you have a trusted banking relationship, it could work in your favor. Many banks and credit unions offer small business loans or equipment financing for investments like printers.

Pros of Financing Through Your Bank:

- You might qualify for lower interest rates than through a third-party leasing company.

- If you’re already working with your bank, you’ll likely have more flexibility and transparency in the loan terms.

Cons of Financing Through Your Bank:

- It takes more legwork, so you’ll need to handle the financing details yourself.

- Approval timelines and credit requirements vary by lender.

If you find that personal financing isn’t offering a lower interest rate, leasing could be a better option. This will help you avoid having to do some of the back-end work required for getting equipment personally financed.

However, personal financing can be a smart option if you want to keep all your financial operations under one roof.

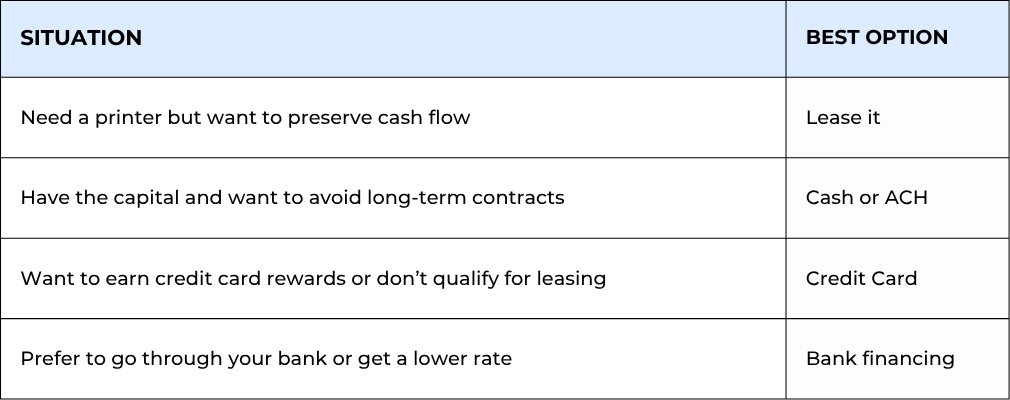

Which Option Is Right for You?

It all depends on your situation. Here’s a quick guide:

Wherever you are in your buying journey, you’ll want to balance your financial comfort with what makes the most long-term sense for your business.

Before making a decision, consider reading 3 Tips for Saving Money on Your Next Printer/Copier to better understand how pricing works.

Your Printer Purchase, Your Way

Buying a printer that’s meant to serve your business long-term comes with some decisions that aren't always straightforward. One of the most important is how you’re going to pay for it.

By now, you’ve learned that there’s no one-size-fits-all payment method.

Leasing and purchasing are the common purchasing options but print providers will differ on what they offer beyond that. Less frequent types of payment options, like credit cards or personal financing, can be accessible to you, but their availability will ultimately depend on who you partner with.

Regardless of which payment option you choose, each has its own pros and cons.

At the end of the day, you’re trying to invest wisely in a machine that will meet your needs without draining your cash flow or tying you into a solution that doesn’t work for you. That’s where we come in.

With nearly 40 years in the industry, we’ve put together a guide to help you ensure you’re getting the right printer and paying for it in the smartest way possible. Download our free guide to leasing or purchasing a printer to walk through every decision confidently.

We’re Strategic Technology Partners of Texas, and helping businesses like yours cut through the confusion and find the right print solution is what we do best.

If you know which printer you want and are ready to purchase it, or you need help in finding the right machine for you, reach out to us. We’ll help you find the solution that is best for your situation.